As the old Faberge Organics shampoo (with wheat germ oil and honey) commercial used to say, "If you tell two friends, then they'll tell two friends, and so on and so on and so on." The same goes for the markets. It's the ultimate expression of keeping up withe the Joneses. Everyone covets everyone else's profit-making assets

Trends exist because investor B wants in on the action of investor A. But why?

My reasoning is that trends exist because information flows around the market imperfectly. Some people get it sooner and others later. Some people act aggressively and some not at all. Eventually, everyone assimilates the information but guess what, the market is already way up by then. But that's another topic.

If not for this fact, stocks would only trade the bid-ask spread until the next news or earnings report. They would then jump or fall, in one fell swoop, to the next price level where they would trade around the new bid-ask. It is the imperfect flow of information, either lagging or leading when someone figures out the news before it is releases, that allows smooth trending.

Nowhere but in the financial and commodity markets do people want to buy more as the price goes higher. My economics 1a professor, Barney "guns and butter" Schwalberg would not approve. Yet, in the markets, the more people that want it, the higher the demand and higher the price, and (drum roll) the more other people want it.

Talk about FOMO!

With that said, there is still a bit of sanity left here. If prices rise too fast - and that is clearly subjective - then some people wake up and realize they should probably cash some of this windfall in. Supply increases and sure enough price action heads a bit lower.

This could happen a few times and the market establishes a sustainable trend with a velocity that makes sense for that market at that particular time in history.

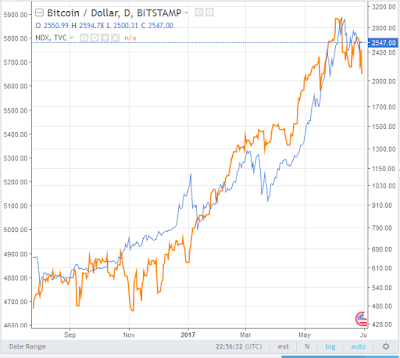

Right now, Bitcoin merits an insanely steep trend. It's new and, as far as a concept can be, really shiny. Maybe next year, when $30 million simply vanishes as it did just this month in competing crypto-currency ethereum, we'll see the market's invisible hand show itself.

Here is the headline "A coding error led to $30 million in ethereum being stolen." That is absolutely frightening, but I digress, as I always do.The real question for most markets most of the time is what do you do with trends. The answer is, "ride them."

The next question is how you tell when they end. The answer is, "the market will tell you."

Huh? So they will ring a bell at the top? or the bottom?

Well, not exactly. It is durn near impossible (yeah, I speak hillbilly) to know when the peak or bottom in any market is happening as it happens. Chances are you will have to give up a bit before the signal becomes somewhat clear. But that's the whole point of stops. They let you ride the trend until it changes.

Now, you may have other constraints such as scaling out of a position after X% and Y% moves. Or maybe you see better opportunities in other markets in trends that are not quite so old. Or your funnymentals change. Whatever your reason, you decide to get out. But that does not mean the trend is over. Only the market knows that.

The old saw, "the trend is your friend" is absolutely, positively true. However, you cannot forget about the second part of that, "until the end." How may people go broke NOT realizing the trend changed and they continue to BFTD? Can you say Internet bust?

Bonus thought: We usually like to lambast the little guy for being in the wrong place at the wrong time. It is the crux of COT (commitments of traders) analysis saying that when the little speculator gets massively long the bullish trend is about to end.

The thing is that the little guy is right during the meat of the trend. Elliott Wavers cleverly call that "wave 3." They may be slow at the start of the trend and overly enthused at the end but the middle of the trend needs the masses to really get going with size and power.

So, you still have to know a little bit about the trend you are in. Identifying that is more than half the battle when you make your buy, sell or hold decisions. Everything else is gravy.