This is a big rounded bottom or saucer. In candles, it's a "fry pan" bottom.

The Quick Takes Pro blog by Michael Kahn, CMT about anything that might affect your portfolio.

Friday, May 27, 2011

Thursday, May 26, 2011

Mr. Softee is still limp

You know the fundie news better'n me but the technicals still look weak.

Check this out. The trend is still down and today's rally did not even break the 20-day expo average, let alone something more important. Next, on-balance volume is still falling. Today's volume was not exactly a barn burner.

I'll give you a small RSI divergence (not shown) but that's about it. Maybe they can tear Paul Allen away from his sports teams to come back.

Check this out. The trend is still down and today's rally did not even break the 20-day expo average, let alone something more important. Next, on-balance volume is still falling. Today's volume was not exactly a barn burner.

I'll give you a small RSI divergence (not shown) but that's about it. Maybe they can tear Paul Allen away from his sports teams to come back.

Wednesday, May 25, 2011

Is this stuff starting to work?

Now that QE2 is winding down, has anyone noticed that good old technicals are starting to work slightly better?

Here is a stock I found this morning as I thumbed through charts with the ignorant bliss of someone not watching earnings reports and corporate news.

To me, it was a head-and-shoulders-like pattern with broken support. Money was bleeding out with nary a blip during the April rally, too.

I can feign ignorance or, as some of you might say, claim ignorance, when it comes to premarket earnings news. I am a technical analyst, after all, and should not care. Of course, TAs are aware of this stuff, even if it does not factor into the analysis.

But here we have a chart with a classic breakdown before the big news broke. Perhaps there is hope for chartists after all.

Here is a stock I found this morning as I thumbed through charts with the ignorant bliss of someone not watching earnings reports and corporate news.

To me, it was a head-and-shoulders-like pattern with broken support. Money was bleeding out with nary a blip during the April rally, too.

I can feign ignorance or, as some of you might say, claim ignorance, when it comes to premarket earnings news. I am a technical analyst, after all, and should not care. Of course, TAs are aware of this stuff, even if it does not factor into the analysis.

But here we have a chart with a classic breakdown before the big news broke. Perhaps there is hope for chartists after all.

Monday, May 23, 2011

New to me

I've used the bullish percent index (BPI) sparingly but today I noticed something a little different. Here is what I wrote in Monday's Quick Takes Pro:

The BPI measures the percentage of stocks in an index on point and figure buy signals. The theory is that a high reading (over 70) following by a decline of more than 6 is a bearish warning for the market. It has not really worked that well during the Fed-goosed rally but there is something here that caught my eye. I see a rather significant divergence between price and indicator.

Does this matter? With a limited set of history on this chart it did seem to say something at the minor 2008 low and the major 2009 low. Let's add this to the bearish side of the ledger as a" maybe."

(Chart courtesy of DecisionPoint.com)

The BPI measures the percentage of stocks in an index on point and figure buy signals. The theory is that a high reading (over 70) following by a decline of more than 6 is a bearish warning for the market. It has not really worked that well during the Fed-goosed rally but there is something here that caught my eye. I see a rather significant divergence between price and indicator.

Does this matter? With a limited set of history on this chart it did seem to say something at the minor 2008 low and the major 2009 low. Let's add this to the bearish side of the ledger as a" maybe."

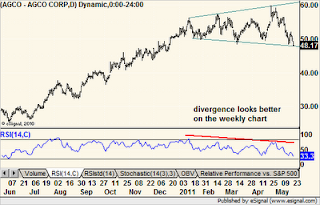

Megaphone

For all of you who have only heard of the expanding triangle, aka megaphone, pattern, here is a doozy.

This one is a peer to Deere and Caterpillar. Apparently, the rush to stock up on food and all things agriculture is over. But megaphone patterns do not officially signal a top until that lower border breaks.

This one is a peer to Deere and Caterpillar. Apparently, the rush to stock up on food and all things agriculture is over. But megaphone patterns do not officially signal a top until that lower border breaks.

Friday, May 20, 2011

Preponderance of evidence

I'd say the stock market is tired and telling us it has had enough of the bull. My thoughts:

I often use the analogy of the civil trial lawyer when talking about how a chartist decides the right action to take. Unless the entire judge and jury was at the scene of the crime as it was happening there is no way anyone can be 100% certain of what happened. So, the prosecution digs for all sorts of evidence including witnesses, forensics, motive, opportunity to commit the crime and anything circumstantial to paint a picture that is consistent with the crime being committed by the defendant.

In charting, we look at trend, momentum, price structure, volume, sentiment, sector considerations and intermarket conditions. The idea is to run through your desired list of items and indicators and see how many fall on the bullish side of the ledger as well as how many are bearish or of no real help. Some seem to be fundamental but I'll give them a technical spin.

Bullish:

The trend remains up.

The Fed says it will not sell its bonds but just stop buying them after QE2. That means supply is not going to balloon and liquidity should remain strong enough to keep the market resilient

Corporate profits and a weak dollar may be all fundamental but it keeps money flowing into the stock market and that is technical.

Bearish

Weekly reversal bars on major indices

Breakdowns and successful tests in several major indices.

Waning momentum

Rash of bond financing by companies with cash already on hand (remember the cry for corporations to deploy their cash to help the economy?)

Lots of IPOs (does not happen at bottoms)

Emerging markets lagging

Tech and financials lagging while defensive sectors leading

There are more. If you were the judge, how would you rule?

I often use the analogy of the civil trial lawyer when talking about how a chartist decides the right action to take. Unless the entire judge and jury was at the scene of the crime as it was happening there is no way anyone can be 100% certain of what happened. So, the prosecution digs for all sorts of evidence including witnesses, forensics, motive, opportunity to commit the crime and anything circumstantial to paint a picture that is consistent with the crime being committed by the defendant.

In charting, we look at trend, momentum, price structure, volume, sentiment, sector considerations and intermarket conditions. The idea is to run through your desired list of items and indicators and see how many fall on the bullish side of the ledger as well as how many are bearish or of no real help. Some seem to be fundamental but I'll give them a technical spin.

Bullish:

The trend remains up.

The Fed says it will not sell its bonds but just stop buying them after QE2. That means supply is not going to balloon and liquidity should remain strong enough to keep the market resilient

Corporate profits and a weak dollar may be all fundamental but it keeps money flowing into the stock market and that is technical.

Bearish

Weekly reversal bars on major indices

Breakdowns and successful tests in several major indices.

Waning momentum

Rash of bond financing by companies with cash already on hand (remember the cry for corporations to deploy their cash to help the economy?)

Lots of IPOs (does not happen at bottoms)

Emerging markets lagging

Tech and financials lagging while defensive sectors leading

There are more. If you were the judge, how would you rule?

Wednesday, May 18, 2011

Another shameful congressional hearing

Did it not make your skin crawl when congress held hearing on steroid use in baseball? How is that an issue for elected officials anywhere outside of baseball and perhaps law enforcement.

I understand why they grilled the auto makers since they were asking for bailouts. And auto makers looked pretty bad with their private jets.

I also - to a limited degree - understand why congress wanted to talk to oil companies since they do get some tax breaks (so I am told). Here is something from energy guru Phil Flynn in his morning missive:

"Last week at a congressional hearing Chevron CEO John Watson wiped the floor with the Democratic leadership that led to a classic and telling exchange with Senator Jay Rockefeller. Rockefeller said that big oil was out of touch and that the American people want big oil to be part of the "shared sacrifice" to get the budget under control. John Watson shot back, "I don't think that the American people want shared sacrifice, I think they want shared prosperity."

Of course, the senator had to give a snippy comeback to show his "power" and save some face. But you cannot un-ring a bell. The public sector is out of touch, not the private sector.

I would greatly enjoy now non-candidate Trump testifying before the "leaders." What a great time to hear "you're fired!"

I understand why they grilled the auto makers since they were asking for bailouts. And auto makers looked pretty bad with their private jets.

I also - to a limited degree - understand why congress wanted to talk to oil companies since they do get some tax breaks (so I am told). Here is something from energy guru Phil Flynn in his morning missive:

"Last week at a congressional hearing Chevron CEO John Watson wiped the floor with the Democratic leadership that led to a classic and telling exchange with Senator Jay Rockefeller. Rockefeller said that big oil was out of touch and that the American people want big oil to be part of the "shared sacrifice" to get the budget under control. John Watson shot back, "I don't think that the American people want shared sacrifice, I think they want shared prosperity."

Of course, the senator had to give a snippy comeback to show his "power" and save some face. But you cannot un-ring a bell. The public sector is out of touch, not the private sector.

I would greatly enjoy now non-candidate Trump testifying before the "leaders." What a great time to hear "you're fired!"

Tuesday, May 17, 2011

Waterboarding the data

OK, torturing the data sounds better but everyone is a spin doctor.

In this morning's Quick Takes Pro (why have you still not taken a free trial?) I wrote about the S&P 500 reaching, or at least getting close enough to an important Fibonacci retracement level. Let's not debate the efficacy of Fibonacci here and stipulate that there are some attractions in the major retracement levels.

Anyway, we've all seen charts with a spaghetti pattern of Fibo retracements, Fibo time projections, Gann Fans, speed lines and possibly all of them together. It is like trying to see the price chart behind several pair of fishnet stockings (you pick your own metaphor). The more lines you dump on, the more likely you will find a line or combination of lines that hits a major turning point.

I remember doing a presentation to Knight-Ridder corporate folks when I was a newbie analyst working for Knight-Ridder Financial. Basically, I cherry picked the right length of data that made the trend of Knight-Ridder stock point up. After the dog and pony show ended, the boss of KR Financial leaned over to me and said appreciatively, "I don't know how you made the stock look good." After all, for the past year or maybe two the stock went absolutely nowhere.

"Lies, damn lies and statistics" - (possibly Benjamin Disraeli but there is debate)

This is why we agonize over log vs. linear. Over where to start drawing a trendline. And over what exactly it means to be "overbought." Indicators can let you have any market opinion you want.

I cope by trying to figure out what circles, lines and arrows actually describe the action as it is right now. When some disagree I believe neither. But I do toss them onto their own sides of the clip board along with everything else I use to see if one side - bull or bear - has a significantly longer list. If it does, then there is a decision to be made. And if there is not, well, welcome to today's market. Pick the side with the small advantage, use good risk control and off you go.

In this morning's Quick Takes Pro (why have you still not taken a free trial?) I wrote about the S&P 500 reaching, or at least getting close enough to an important Fibonacci retracement level. Let's not debate the efficacy of Fibonacci here and stipulate that there are some attractions in the major retracement levels.

Anyway, we've all seen charts with a spaghetti pattern of Fibo retracements, Fibo time projections, Gann Fans, speed lines and possibly all of them together. It is like trying to see the price chart behind several pair of fishnet stockings (you pick your own metaphor). The more lines you dump on, the more likely you will find a line or combination of lines that hits a major turning point.

I remember doing a presentation to Knight-Ridder corporate folks when I was a newbie analyst working for Knight-Ridder Financial. Basically, I cherry picked the right length of data that made the trend of Knight-Ridder stock point up. After the dog and pony show ended, the boss of KR Financial leaned over to me and said appreciatively, "I don't know how you made the stock look good." After all, for the past year or maybe two the stock went absolutely nowhere.

"Lies, damn lies and statistics" - (possibly Benjamin Disraeli but there is debate)

This is why we agonize over log vs. linear. Over where to start drawing a trendline. And over what exactly it means to be "overbought." Indicators can let you have any market opinion you want.

I cope by trying to figure out what circles, lines and arrows actually describe the action as it is right now. When some disagree I believe neither. But I do toss them onto their own sides of the clip board along with everything else I use to see if one side - bull or bear - has a significantly longer list. If it does, then there is a decision to be made. And if there is not, well, welcome to today's market. Pick the side with the small advantage, use good risk control and off you go.

Friday, May 13, 2011

Tales from the MTA seminar

Not so much tales as reporting what we already knew - volume is not really working so well, and price is still king.

There as a discussion from a floor trader who mentioned ETFs and there ever fluctuating issue sizes. I'll toss in the other non-stock methods for hedging such as options and you can see how someone could hold on to a losing position hedged buy a triple inverse ETF. Figure 1/3 of the volume for that "trade" and then multiply by the number of ways to do it without even using a US based instrument.

I am not an expert in trade strategies so don't flame me if I get the details wrong. You get the idea. The gist was that volume is less useful than it was and I say it joins tick-based data such as the ARMS index and tick by tick money flow.

Otherwise, the presentations left me wanting more - not because they were awesome but because I wanted to actually learn a few things. It was nice to hear about how the top technicians around the globe got their start and more importantly kept their jobs over the years but that does not help me make money for my clients. It was more of a rah-rah, TA is cool thing and better suited for perhaps a smaller panel as we ate our lunch.

I am indeed sorry I could not make it to the floor of the NYSE for the Wed evening cocktail party. Now that would have been awesome, no matter what happened. But I did make it to the Museum of American Finance Thursday evening for the second cocktail party and presentation of the Annual MTA Award and the Charles Dow Award.

The museum had old technology on display including a Quotron. Who cut their teeth on one of those? And there was also a copy of the NY Times from October 20, 1987 with a chart of the Dow crashing. It was sourced to "Knight Ridder Tradecenter," my employer before Bridge bought it.We were awesome back then.

Anyway, there were presentations on cloud charts, structure of the market from an NYSE insider and others but I still wanted to see a beginner track where we teach a few basic indicators or patterns and an advanced track where cutting edge analysis is presented. I miss "walkabout" where we had forced socialization and newbies can rub elbows with the legends (I suppose I am neither).

"A" for effort, planning committee for the venue, activities and attention to budget. But I am afraid there really was no distinct theme or and maybe not enough direct benefit for CMT candidates. Perhaps I am just a dinosaur pining for the old seminars in Florida.

There as a discussion from a floor trader who mentioned ETFs and there ever fluctuating issue sizes. I'll toss in the other non-stock methods for hedging such as options and you can see how someone could hold on to a losing position hedged buy a triple inverse ETF. Figure 1/3 of the volume for that "trade" and then multiply by the number of ways to do it without even using a US based instrument.

I am not an expert in trade strategies so don't flame me if I get the details wrong. You get the idea. The gist was that volume is less useful than it was and I say it joins tick-based data such as the ARMS index and tick by tick money flow.

Otherwise, the presentations left me wanting more - not because they were awesome but because I wanted to actually learn a few things. It was nice to hear about how the top technicians around the globe got their start and more importantly kept their jobs over the years but that does not help me make money for my clients. It was more of a rah-rah, TA is cool thing and better suited for perhaps a smaller panel as we ate our lunch.

I am indeed sorry I could not make it to the floor of the NYSE for the Wed evening cocktail party. Now that would have been awesome, no matter what happened. But I did make it to the Museum of American Finance Thursday evening for the second cocktail party and presentation of the Annual MTA Award and the Charles Dow Award.

The museum had old technology on display including a Quotron. Who cut their teeth on one of those? And there was also a copy of the NY Times from October 20, 1987 with a chart of the Dow crashing. It was sourced to "Knight Ridder Tradecenter," my employer before Bridge bought it.We were awesome back then.

Anyway, there were presentations on cloud charts, structure of the market from an NYSE insider and others but I still wanted to see a beginner track where we teach a few basic indicators or patterns and an advanced track where cutting edge analysis is presented. I miss "walkabout" where we had forced socialization and newbies can rub elbows with the legends (I suppose I am neither).

"A" for effort, planning committee for the venue, activities and attention to budget. But I am afraid there really was no distinct theme or and maybe not enough direct benefit for CMT candidates. Perhaps I am just a dinosaur pining for the old seminars in Florida.

Wednesday, May 11, 2011

MTA Symposeum

Although I will miss the cocktail reception on the floor of the NYSE today, I will be attending the annual Market Technicians Assoc seminar Thursday and Friday in NYC. Over the next dew days, I'll report on anything new in the world of charts or anything new in the movement of people within the profession.

What I am looking for more than anything is reason to believe that I am not banging my head against the wall applying "age old" and "proven" techniques to a market that is totally different than it used to be. No, not "this time it's different" but rather the principles upon which markets operated may be irreversibly altered. Forget margin requirements - the pros will figure out the next weakness to exploit. It is the fact that the mood of the masses, the actual desire by humans to buy and sell is different. High frequency trading is the satanic spawn of index arbitrage and PhDs in math. False liquidity via the Fed. Meddling by all governments. You name it - this is not a free market.

So, I will pay special attention to new techniques that were created in recent years and tested in the current environment. Volume divergences mean bupkis these days but maybe tweet counts and googly searches mean something. Or maybe the simple democrat/republican ratio. Or re-election rate for incumbents. Or rate of repatriation of profits. Or the color of Jim Rogers' bow tie.

There has to be something new that is not rooted in an old market. I'll let you know what I find.

What I am looking for more than anything is reason to believe that I am not banging my head against the wall applying "age old" and "proven" techniques to a market that is totally different than it used to be. No, not "this time it's different" but rather the principles upon which markets operated may be irreversibly altered. Forget margin requirements - the pros will figure out the next weakness to exploit. It is the fact that the mood of the masses, the actual desire by humans to buy and sell is different. High frequency trading is the satanic spawn of index arbitrage and PhDs in math. False liquidity via the Fed. Meddling by all governments. You name it - this is not a free market.

So, I will pay special attention to new techniques that were created in recent years and tested in the current environment. Volume divergences mean bupkis these days but maybe tweet counts and googly searches mean something. Or maybe the simple democrat/republican ratio. Or re-election rate for incumbents. Or rate of repatriation of profits. Or the color of Jim Rogers' bow tie.

There has to be something new that is not rooted in an old market. I'll let you know what I find.

Tuesday, May 10, 2011

Commodities Perspective

For those of you with some miles under your belt, you might remember a company called "Commodity Perspectives" owned by Knight-Ridder and then by Bridge Information Systems via acquisition of Knight-Ridder Financial. Ah, the good old days when the CRB index was actually owned and operated by the CRB (Commodities Research Bureau) and both the CRB and CP nicely complemented the financial information of the rest of Bridge.

But I digress. The whole Bridge world collapsed under foolish expansion (mostly buying Telerate) and we lowly employees are in diaspora.

Let's put some perspective on commodities. Yeah, we know speculators in the thin silver market got spooked by margin requirements. We also knew it was wildly out of whack. Then came the crash of the first week of May.

Crash? Really? 1929 was a crash. 1987 was a crash. 2008 was a crash. Does anyone recall 2001 being labeled as a crash? Even the days surrounding the 9/11 attacks?

So why was a 14.7% drop in crude oil a crash? I'll give you the 30% drop in silver but don't crashes usually come as a surprise? Did anyone really think a selloff was not pending?

Check out this chart of the old CRB index - the good one with a nice representation of commodites (vs. the bastardized spawn with heavy energy weightings to reflect the economy - wait a minute, that's not core! but I digress again).

Why was last week called a crash but the exact same move in March was name-less? Was everyone distracted by Japan?

Let's put this argument to bed right now - no crash in commodities. Silver maybe but not "commodities" and the implication is that the world is the same as it was before last week. Commodities as an asset class are Jim Rogers' fave and I concur.

But I digress. The whole Bridge world collapsed under foolish expansion (mostly buying Telerate) and we lowly employees are in diaspora.

Let's put some perspective on commodities. Yeah, we know speculators in the thin silver market got spooked by margin requirements. We also knew it was wildly out of whack. Then came the crash of the first week of May.

Crash? Really? 1929 was a crash. 1987 was a crash. 2008 was a crash. Does anyone recall 2001 being labeled as a crash? Even the days surrounding the 9/11 attacks?

So why was a 14.7% drop in crude oil a crash? I'll give you the 30% drop in silver but don't crashes usually come as a surprise? Did anyone really think a selloff was not pending?

Check out this chart of the old CRB index - the good one with a nice representation of commodites (vs. the bastardized spawn with heavy energy weightings to reflect the economy - wait a minute, that's not core! but I digress again).

Why was last week called a crash but the exact same move in March was name-less? Was everyone distracted by Japan?

Let's put this argument to bed right now - no crash in commodities. Silver maybe but not "commodities" and the implication is that the world is the same as it was before last week. Commodities as an asset class are Jim Rogers' fave and I concur.

Saturday, May 7, 2011

Watch the kiddies

I just got back from Miami where I helped my son pack up his college dorm room and return home for the summer. As comfortable as I felt in a college setting, I knew with one glance in the mirror that I did not belong - but that is another story.

It started in the airport. My son plugged his laptop in to the charging station and his iPhone into his computer to charge it. He told me ATT used to let him run the internet on his computer via his phone but that was cut off. So, he let the phone charge and played a game on the computer. Not much story there other than the connectivity of devices.

When we got on the plane, he logged into the pay internet service using a credit card (mine, of course) and this is where is started. I call it meta-tasking, a level of multitasking above the capabilities of even a computer fluent guy like me. (meta - "higher, beyond," from Gk. meta (prep.))

He flipped back and forth among at least four sites I could recognize though my reading glasses - tumblr, liarblog, facebook, the airline's flight tracker and who knows what else. He clicked on videos to allow them to load on the slow ariplane network, flipped to read some funny stuff elswhere, clicked to have conversations with four frinds on facebook at the same time, came back to watch the loaded video, then back to pictures, then funny stuff, then more videos, then the flight status...........

I got dizzy watching him. Windows were flying - front to background, back to foreground, all displayed at the same time (sort of tiled). But I sure ingested a lot of humor and guys doing dumb stuff ending with a crotch landing on a hand rail.

This kid types faster with one thumb on his iPhone than I type with two hands on my regular keyboard. And if I don't have my glasses, well, you know.

How does this relate to investing? There must be something there to harness all this meta-tasking. I have no idea what but unless you spend time with the kids you will have no clue how they function in the world. Thy may not have jobs just yet but they will and they will want technology that allows them to do a dozen things at the same time. And they want internet sites that keep up.

I am happy I can write my column with Pandora radio playing on the same computer.

It started in the airport. My son plugged his laptop in to the charging station and his iPhone into his computer to charge it. He told me ATT used to let him run the internet on his computer via his phone but that was cut off. So, he let the phone charge and played a game on the computer. Not much story there other than the connectivity of devices.

When we got on the plane, he logged into the pay internet service using a credit card (mine, of course) and this is where is started. I call it meta-tasking, a level of multitasking above the capabilities of even a computer fluent guy like me. (meta - "higher, beyond," from Gk. meta (prep.))

He flipped back and forth among at least four sites I could recognize though my reading glasses - tumblr, liarblog, facebook, the airline's flight tracker and who knows what else. He clicked on videos to allow them to load on the slow ariplane network, flipped to read some funny stuff elswhere, clicked to have conversations with four frinds on facebook at the same time, came back to watch the loaded video, then back to pictures, then funny stuff, then more videos, then the flight status...........

I got dizzy watching him. Windows were flying - front to background, back to foreground, all displayed at the same time (sort of tiled). But I sure ingested a lot of humor and guys doing dumb stuff ending with a crotch landing on a hand rail.

This kid types faster with one thumb on his iPhone than I type with two hands on my regular keyboard. And if I don't have my glasses, well, you know.

How does this relate to investing? There must be something there to harness all this meta-tasking. I have no idea what but unless you spend time with the kids you will have no clue how they function in the world. Thy may not have jobs just yet but they will and they will want technology that allows them to do a dozen things at the same time. And they want internet sites that keep up.

I am happy I can write my column with Pandora radio playing on the same computer.

Wednesday, May 4, 2011

Facebooking instead of blogging

By now, you've noticed the blog has been really sparse in terms of regular updates. I hope you have seen the scrolling window to the right --> with updates fed from my Facebook page. There are always several updates per day there.

My question for all with a focus on people using social media for business is whether you find the same redundancy I now see. I use my Facebook status pretty much like Twitter with quick bits of information, links and charts. Further, it gets sent over to my LinkedIn account for even wider distribution.

I get the feeling this kind of communication is saturating intended targets making it all less valuable. Personally, I do not follow anyone on Twitter. Most of the time they reference links to stories which I do not have time to read. Or, they tweet so much that I have to sit there watching a live data feed to keep up. Nobody with a job has time for that.

Oh, and I am talking about just following one person. What if I follow the hundreds that I see many others follow. Noise, noise, noise.

I like doing the Facebook updates although I am also guilty sometimes of posting links. But I do post charts and I do make quick market comments (such as yesterday's "oil services stocks look sickly.")

Let me know how I can interact with all of you so it is not 1) boring or 2) noise. Keep in mind that I am not going to cannibalize my pay service to do it.

My question for all with a focus on people using social media for business is whether you find the same redundancy I now see. I use my Facebook status pretty much like Twitter with quick bits of information, links and charts. Further, it gets sent over to my LinkedIn account for even wider distribution.

I get the feeling this kind of communication is saturating intended targets making it all less valuable. Personally, I do not follow anyone on Twitter. Most of the time they reference links to stories which I do not have time to read. Or, they tweet so much that I have to sit there watching a live data feed to keep up. Nobody with a job has time for that.

Oh, and I am talking about just following one person. What if I follow the hundreds that I see many others follow. Noise, noise, noise.

I like doing the Facebook updates although I am also guilty sometimes of posting links. But I do post charts and I do make quick market comments (such as yesterday's "oil services stocks look sickly.")

Let me know how I can interact with all of you so it is not 1) boring or 2) noise. Keep in mind that I am not going to cannibalize my pay service to do it.

Subscribe to:

Comments (Atom)