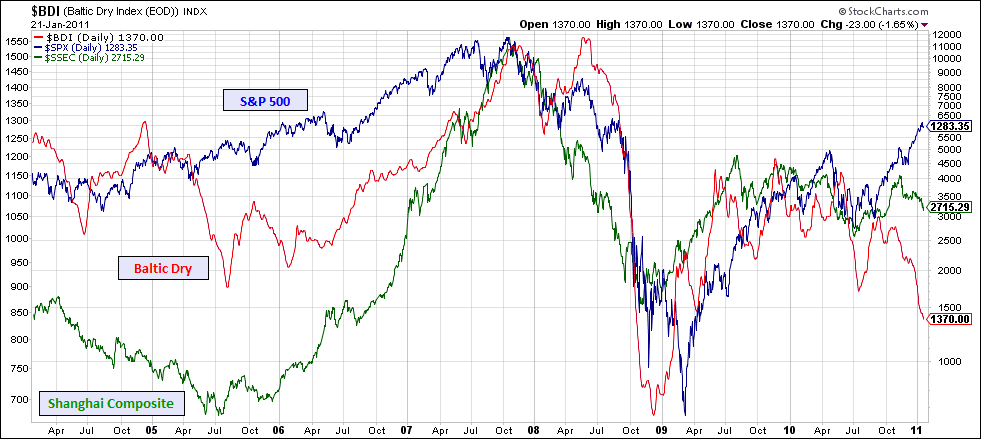

Today's Barron's Online column talked about the decline of shipping stocks and the Baltic Dry Index (BDI), which keeps tabs on how much it costs to hire those mega-behemoth tanker ships. The theory is that falling demand means lower shipping prices and then lower stock prices. I even saw someone overlay the BDI witht he S&P 500 and the Shanghai composite. Excellent hypothesis, especially with China gobbling up all the raw materials and shipping their finished crap back to us.

Without disparaging anyone else's work, the falling in the BDI does not provide the reason for deflation. Stocks are up but the index is way down so you'd think stocks would correct towards the BDI.

Chart lifted from Seeking Alpha but totally reproducable on your own via the free Stockscharts.com.

I think the divergence between the BDI and stock prices means the opposite. First of all, the correlation here is limited. But if we assume it is good, to me it is stocks that lead the BDI and not the other way around. That is another of my arguments for inflation, not deflation in the coming years.

1 comment:

Today's was a good column in Barrons, but I wonder why you didn't include the conclusion that you made in your blog - that the downward looking shipping stocks aren't presaging a general market decline.

The weekness in the BDI and the shipping rates was explained by a funnymentalist a month or so ago - it seems there is a lot of overcapacity in the shipping industry these days. He expects it to turn around sometime soon. There were quite a few numbers and a brief of recent history offered, but I can't recall them.

Essentially, using BDI to forecast the general economy is a bit misleading - one needs to be aware of capacity utilization of fleets, but then again that forces us to deal with funnymentals...

Post a Comment