Thursday started with a bang as the ECB chief pledged the first born children of every German citizen to save the euro. Friday, the fun continued as the world was lovin' itself some central bankers even though US economic news was lousy. Bring it on! The worse the news the more likely for a helicopter sighting.

From Wikipedia - The phrase "when pigs fly" is an adynaton — a figure of speech so hyperbolic that it describes an impossibility.

Well, in the stock market, the PIIGS were certainly on the wing over the past few days. Spain up 16% from Wednesday's close through intraday Tuesday. Italy 12%. Even Germany was up 7%. Greece did not move much since it is already dead.

Maybe it was magic lipstick they slapped on these failing economies (not Germany). Rather, it was another dose of free money - or the prospects of more money - that made a dead man come alive (cleaned up to be less Jaggeresque).

Guess what? People are getting wise the the game. Each dose of QE resulted in smaller and shorter lasting gains. If "everyone" now expects more money printing, guess what the market will do when it happens. Hint - it won't go up at least not after the knees stop jerking.

Short of hugs and kisses across the aisle in DC, you should be preparing for a plunge. Mario Draghi has set us up for disappointment and the market hates that.

You know that I care what happens to you,

And I know that you care for me.

So I don't feel alone,

Or the weight of the stone,

Now that I've found somewhere safe

To bury my bone.

And any fool knows a dog needs a home,

A shelter from pigs on the wing.

- Pink Floyd, Pigs on the Wing (1977)

The Quick Takes Pro blog by Michael Kahn, CMT about anything that might affect your portfolio.

Tuesday, July 31, 2012

Thursday, July 26, 2012

Sugar Rush

Sugar, ah honey honey

You are my candy girl

And you've got me wanting you.

I just can't believe the loveliness of loving you

(I just can't believe it's true)

I just can't believe the one to love this feeling to.

(I just can't believe it's true)

- Sugar Sugar, The Archies (1969 )

Or, for you bubblegum metal fans, how about "Pour some sugar on me" by Def Leppard?

Mario Draghi was the candy man today (Sorry, Sammy Davis Jr.). With his "we will do whatever it takes" rhetoric to save the euro it was like dropping Wall Street into Willy Wonka's factory. Kid in a candy shop. Yum, eat 'em up! Stock good!

Wow, the ECB chief beat the Fed Chief to the punch.

Let's think about this for a second. The Dow was down 267 points, including the Wednesday bounce, in the prior four days. It was time for some bottom fishing so the market was ready. Enter sandman, er, Draghi and his lip service lit the fuse.

Hmmm, what did Queen Merkel say about it? Is she on board? And haven't we seen this movie before? A central banker barks but the market feels no bite.

You know what happens when the sugar high wears off, as it very well may do tomorrow. You crash and burn. For you less dramatic types, it is that two o'clock feeling when your energy grinds down to nothing.

Show us the money, Mr. Draghi. And even if you do, Spain is going down. Greece cannot keep austerity and the dominos will fall.

And really, no love on Facebook and Twitter for noticing that Draghi and Drago (from Rocky) are very similar names? I even put it up on Pinterest for easy re-pinning.

You are my candy girl

And you've got me wanting you.

I just can't believe the loveliness of loving you

(I just can't believe it's true)

I just can't believe the one to love this feeling to.

(I just can't believe it's true)

- Sugar Sugar, The Archies (1969 )

Or, for you bubblegum metal fans, how about "Pour some sugar on me" by Def Leppard?

Mario Draghi was the candy man today (Sorry, Sammy Davis Jr.). With his "we will do whatever it takes" rhetoric to save the euro it was like dropping Wall Street into Willy Wonka's factory. Kid in a candy shop. Yum, eat 'em up! Stock good!

Wow, the ECB chief beat the Fed Chief to the punch.

Let's think about this for a second. The Dow was down 267 points, including the Wednesday bounce, in the prior four days. It was time for some bottom fishing so the market was ready. Enter sandman, er, Draghi and his lip service lit the fuse.

Hmmm, what did Queen Merkel say about it? Is she on board? And haven't we seen this movie before? A central banker barks but the market feels no bite.

You know what happens when the sugar high wears off, as it very well may do tomorrow. You crash and burn. For you less dramatic types, it is that two o'clock feeling when your energy grinds down to nothing.

Show us the money, Mr. Draghi. And even if you do, Spain is going down. Greece cannot keep austerity and the dominos will fall.

And really, no love on Facebook and Twitter for noticing that Draghi and Drago (from Rocky) are very similar names? I even put it up on Pinterest for easy re-pinning.

Tuesday, July 24, 2012

Let it go, Ben

This from the Wall Street Journal this afternoon:

Print more money? That just enriches banks and gives the stock market a sugar rush.

Buy more mortgages? Rates are already at all time lows.

Cut the Fed Funds rate? Hmmm, below zero would be fun.

Just what exactly can you do? Here's a novel idea, why not ask businesses what they would like done? Guess what they do not want - more money printing. Food prices WILL be going up this year so debasing the currency is just dumb. No, the crumbling euro is not going to cover that because there are other currencies out there that will soar.

On second thought, go ahead, Ben, do it. I am already long gold - which, by the way has a lousy sentiment reading right now and a price compression to launch it into space.

Federal Reserve officials, impatient with the economy's sluggish growth and high unemployment, are moving closer to taking new steps to spur activity and hiring. Since their June policy meeting, officials have made clear—in interviews, speeches and testimony to Congress—that they find the current state of the economy unacceptable. Many officials appear increasingly inclined to move unless they see evidence soon that activity is picking up on its own.My question is move to do what?

Print more money? That just enriches banks and gives the stock market a sugar rush.

Buy more mortgages? Rates are already at all time lows.

Cut the Fed Funds rate? Hmmm, below zero would be fun.

Just what exactly can you do? Here's a novel idea, why not ask businesses what they would like done? Guess what they do not want - more money printing. Food prices WILL be going up this year so debasing the currency is just dumb. No, the crumbling euro is not going to cover that because there are other currencies out there that will soar.

On second thought, go ahead, Ben, do it. I am already long gold - which, by the way has a lousy sentiment reading right now and a price compression to launch it into space.

Monday, July 23, 2012

Cheap is not always cheap

I've been watching stocks that break like Chipotle broke last week. You see stories right after the move saying they are a buy now. Why? Because the price is down and fundamentals have not really changed - yet. That kind of advice is certainly better than downgrading the stock to "market perform" after the break.

But when stocks break that kind of size, they are indeed broken, not on sale. Just look at Green Mountain Coffee (and its P/E was not in the 50s before the break).

or Best Buy in 2010-2011.

or Netflix

or Cisco

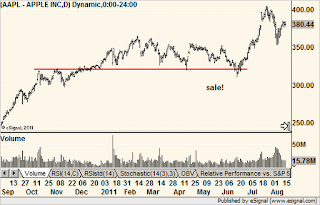

Take a look at a stock on sale. Apple sold off and broke support in 2011 only to recover instantly. Note the day of the low, in candlesticks, was a hammer, too.

A false breakdown is a sale price. A giant gap down is a mortal wound.

But when stocks break that kind of size, they are indeed broken, not on sale. Just look at Green Mountain Coffee (and its P/E was not in the 50s before the break).

or Best Buy in 2010-2011.

or Netflix

or Cisco

Take a look at a stock on sale. Apple sold off and broke support in 2011 only to recover instantly. Note the day of the low, in candlesticks, was a hammer, too.

A false breakdown is a sale price. A giant gap down is a mortal wound.

Thursday, July 19, 2012

PT Barnum lives!

We all get those unwanted emails telling us such an such a stock will triple or quintuple or even decuple so you better get in now. The company is riding the new wave of the future to massive profits. You were tempted from time to time to throw up a chart, weren't you?

Well, the word decuple (10 times) sounds a lot like de-couple, as in from reality. And if you fell for it you not only threw up a chart but you threw up on your chart.

Check out Vidable. I really don't give a hoot what they sell so don't ask. You can see when I started to get those emails - from multiple sources in multiple formats. And you can see what happened when the suckers bought millions of shares of this ghost. And what happened when the pumpers became dumpers.

This makes me very happy, though. No, I was not a pump and dumper. What makes me happy is to know that human nature will always be the same. Presidents come and go. Fed Chairmen come and go. Third world regimes come and go. But there is a sucker born every minute.

Although not quite as rude as that, it is the basis for technical analysis. The premise that "people do similar things when faced with similar circumstances" means that charts will always work. That's a good thing for anyone invested in getting their CMT designation.

The problem these days is nobody has been faced with similar circumstances. We've never been in so much debt (globally). We've never tried to print our way out of it. And we've never been this hamstrung by too much government.

If you can figure out what similar things people will do under these conditions then riches await you.

Well, the word decuple (10 times) sounds a lot like de-couple, as in from reality. And if you fell for it you not only threw up a chart but you threw up on your chart.

This makes me very happy, though. No, I was not a pump and dumper. What makes me happy is to know that human nature will always be the same. Presidents come and go. Fed Chairmen come and go. Third world regimes come and go. But there is a sucker born every minute.

Although not quite as rude as that, it is the basis for technical analysis. The premise that "people do similar things when faced with similar circumstances" means that charts will always work. That's a good thing for anyone invested in getting their CMT designation.

The problem these days is nobody has been faced with similar circumstances. We've never been in so much debt (globally). We've never tried to print our way out of it. And we've never been this hamstrung by too much government.

If you can figure out what similar things people will do under these conditions then riches await you.

Tuesday, July 17, 2012

I am FED up, are you?

Here is an excerpt from this morning's Quick Takes Pro (yes, I am peddling it. Have you taken a free trial yet?):

This morning, I heard a strategist I do respect talking about what the Fed can and cannot do. First, she said there is diminishing returns with any stimulus. I agree.

But when asked what the Fed can actually do she said they would not focus on Treasuries but instead look at mortgages. This would help a recovering industry by lowering mortgage rates.

Uh, excuse me. Aren't mortgage rates at all-time lows already?

I am truly fed up with all of this bravado. The Fed cannot fix the economy. If you want to the runner to run faster, stop giving him more weights (regulations and laws) to carry.

Meddling with the free market is In-saaaane!

It all boils down to "will he or won’t he?" Will there be QE3 or not? No wonder investors are out of the market as there is no way to probe the mind of a mad man.The Fed still thinks they have bullets left to "fix" the economy. It doesn't. In fact, it never did. The fix is not to fix it. But that is a much longer discussion.

Whoa! Did we just say that? Well, let's refer back to Einstein's definition of insanity - doing the same thing over and over again and expecting different results.

This morning, I heard a strategist I do respect talking about what the Fed can and cannot do. First, she said there is diminishing returns with any stimulus. I agree.

But when asked what the Fed can actually do she said they would not focus on Treasuries but instead look at mortgages. This would help a recovering industry by lowering mortgage rates.

Uh, excuse me. Aren't mortgage rates at all-time lows already?

I am truly fed up with all of this bravado. The Fed cannot fix the economy. If you want to the runner to run faster, stop giving him more weights (regulations and laws) to carry.

Meddling with the free market is In-saaaane!

Tuesday, July 10, 2012

Tease Me Baby

Fire and Ice

You come on like a flame

Then you turn a cold shoulder

Fire and Ice

I wanna give you my love

But you'll just take a little piece of my heart

---Pat Benatar, Fire and Ice (1984)

I remarked in Quick Takes Pro over the past week that the news was a predictable as the sun rising in the east every morning. Thursday, it was good new from China, the ECB and BOE. Friday it was bad news from the US with a lousy jobs report. Monday it was a German taxpayer revolt (sort of) killing the stock market. Tuesday, true to form, whopee! They are bailing out the Spanish banks.

Didn't they do that already? The market thought so and teased the bulls with an early 80-point Dow rally that evaporated. Then sat there - teasing, teasing. Until the bottom dropped out.

Fire and ice.

I have a feeling that we are going to see nothing until the election but chop, chop, chop unless one of three things happens:

1 - it becomes apparent that one side or the other will will the Presidency (stocks tank or soar)

2 - Europe implodes for real (beats me what happens)

3 - Central banks wake up and get the heck out of the way (stocks tank)

And you can take that to the bank. Invest it in LIBOR. I mean beer.

You come on like a flame

Then you turn a cold shoulder

Fire and Ice

I wanna give you my love

But you'll just take a little piece of my heart

---Pat Benatar, Fire and Ice (1984)

I remarked in Quick Takes Pro over the past week that the news was a predictable as the sun rising in the east every morning. Thursday, it was good new from China, the ECB and BOE. Friday it was bad news from the US with a lousy jobs report. Monday it was a German taxpayer revolt (sort of) killing the stock market. Tuesday, true to form, whopee! They are bailing out the Spanish banks.

Didn't they do that already? The market thought so and teased the bulls with an early 80-point Dow rally that evaporated. Then sat there - teasing, teasing. Until the bottom dropped out.

Fire and ice.

I have a feeling that we are going to see nothing until the election but chop, chop, chop unless one of three things happens:

1 - it becomes apparent that one side or the other will will the Presidency (stocks tank or soar)

2 - Europe implodes for real (beats me what happens)

3 - Central banks wake up and get the heck out of the way (stocks tank)

And you can take that to the bank. Invest it in LIBOR. I mean beer.

Friday, July 6, 2012

The USA is broken

Now that I've got your attention, let me explain.

The USA is still the only place I want to be. Sorry, rest of the world, I mean it. But with that said it is no wonder that the jobs data were crappy again. Don't we have to grow 200,000 jobs per month to keep up with the population? At 80,000, we are shrinking like a wet witch in Oz.

Here comes the lion and the zebra analogy again.

This time, I'll apply it to the government itself. First, I am a libertarian, not an anarchist. We need government to provide many functions but I am not going to go there in a blog that supposed to be about money.

But those who serve in the government have a built in incentive NOT to fix things. What? Wait a minute!

We send the lions to Washington, or the State House or the Mayor's office and expect them to eat broccoli. They eat zebras and we wonder why the economy is in the pooper. Keep reading.

We send politicians to get together; each representing their constituents. What that usually means is getting projects for the home state or appropriations for that local factory or disaster relief for the neighborhood after a flood, fire or hurricane. Roar! Give me a zebra to take back to my pride!

Getting it now? Where is there the incentive to cut taxes on people NOT in their district? Where is the reasons to say "you know, the country cannot afford giving my constituents that shovel ready bridge to nowhere and we should not pass that bill?"

There is no place in the legislative branch that represents all of the people all of the time without regard to home state or city. The president is not in the legislative branch so don't say he is the dude to do it.

Rewrite the constitution? Tall order and it is a pretty good document as is. My point is that we tell our congressmen and senators to go to DC to represent us and when they all disagree on how much stuff to give to their own districts we give them a 9% approval rating.

Lions don't eat broccoli.

Again, what to do? Creating a third branch of congress ain't gonna happen. Term limits seem to be a good idea. So does repealing the 17th amendment (look it up). At least the states had direct representation in Washington before just as the founders wanted it.

As I said, I would not want to live anywhere else and I would not want any other system. But the unintended consequences of democracy are clear. (You know, like two wolves and a sheep voting on what to have for dinner.)

How about we eliminate broad swaths of the bureaucracy, eliminate lobbyists and create a new elected national office called the People's Advocate (100 new people vs the tens of thousands now on the government dole). Its sole mission would be keeping congress focused on the country as a whole and not getting stuff for their constituents so they will be re-elected. Congress would not only have to be responsible to their home turf but fear the sunlight shining on it by the Advocate.

And for you more sinister types who love checks and balances, how about allowing negative votes (weighted)? If I live in West Eastovia and think Mr. X from tf North Southolina is a crook I can vote against him. Reach a certain number or negative votes and you're out!

Just a thought and a raw one at that. But the government has to represent all of the people, not just the sum of all the districts.

The USA is still the only place I want to be. Sorry, rest of the world, I mean it. But with that said it is no wonder that the jobs data were crappy again. Don't we have to grow 200,000 jobs per month to keep up with the population? At 80,000, we are shrinking like a wet witch in Oz.

Here comes the lion and the zebra analogy again.

This time, I'll apply it to the government itself. First, I am a libertarian, not an anarchist. We need government to provide many functions but I am not going to go there in a blog that supposed to be about money.

But those who serve in the government have a built in incentive NOT to fix things. What? Wait a minute!

We send the lions to Washington, or the State House or the Mayor's office and expect them to eat broccoli. They eat zebras and we wonder why the economy is in the pooper. Keep reading.

We send politicians to get together; each representing their constituents. What that usually means is getting projects for the home state or appropriations for that local factory or disaster relief for the neighborhood after a flood, fire or hurricane. Roar! Give me a zebra to take back to my pride!

Getting it now? Where is there the incentive to cut taxes on people NOT in their district? Where is the reasons to say "you know, the country cannot afford giving my constituents that shovel ready bridge to nowhere and we should not pass that bill?"

There is no place in the legislative branch that represents all of the people all of the time without regard to home state or city. The president is not in the legislative branch so don't say he is the dude to do it.

Rewrite the constitution? Tall order and it is a pretty good document as is. My point is that we tell our congressmen and senators to go to DC to represent us and when they all disagree on how much stuff to give to their own districts we give them a 9% approval rating.

Lions don't eat broccoli.

Again, what to do? Creating a third branch of congress ain't gonna happen. Term limits seem to be a good idea. So does repealing the 17th amendment (look it up). At least the states had direct representation in Washington before just as the founders wanted it.

As I said, I would not want to live anywhere else and I would not want any other system. But the unintended consequences of democracy are clear. (You know, like two wolves and a sheep voting on what to have for dinner.)

How about we eliminate broad swaths of the bureaucracy, eliminate lobbyists and create a new elected national office called the People's Advocate (100 new people vs the tens of thousands now on the government dole). Its sole mission would be keeping congress focused on the country as a whole and not getting stuff for their constituents so they will be re-elected. Congress would not only have to be responsible to their home turf but fear the sunlight shining on it by the Advocate.

And for you more sinister types who love checks and balances, how about allowing negative votes (weighted)? If I live in West Eastovia and think Mr. X from tf North Southolina is a crook I can vote against him. Reach a certain number or negative votes and you're out!

Just a thought and a raw one at that. But the government has to represent all of the people, not just the sum of all the districts.

Sunday, July 1, 2012

The Pendulum Swings

Today is Sunday so I think I can talk a bit about politics instead of markets. Don't worry, I am not taking sides. While it is true the market has a monster pendulum - called fear and greed - I have seen a bigger, more sinister one in the general population.

I know the view from my perch is partially perceived. I am older and hopefully a smidge wiser. I am certainly more informed than I was in my post-college days. Forget about the sweet bliss of academe.

Anyway, the 2000 Presidential contest was terrible. I do not recall much about Dubbya and did not see Gore as his polar opposite at the time. But the way the election was decided really set the people off in opposite directions. Again, I am not taking sides here.

My thoughts about 43 were not favorable but he did rally the country post 9-11. It was when people's pocketbooks got shredded in 2008 that I think the backlash against anything related to elephants began. The tide sweeping 44 into office and flooding the congress with the donkeys was indeed a political tsunami.

The pendulum had swung to an extreme.

Then came 2010 and the Tea Party rode the pendulum to the other side. Or did it? It seems that those coming into power did not fulfill their promise and back went the pendulum. Occupy arose.

But thanks to the the economy, the pendulum started to move yet again. Enter SCOTUS on healthcare and the afterburners kicked in.

We've had back and forth in this country since it began. But over the past two presidents the magnitude of the swings seems to have grown exponentially. A Canadian colleague just asked in a Facebook thread, "Why is the US so divided and hateful? This has gone away past politics."

Indeed.

I have no solution although I would support term limits in congress. Can our leaders actually do the work we hired them to do instead of working from day one on their re-election? Donkeys and Elephants are both guilty.

I know the view from my perch is partially perceived. I am older and hopefully a smidge wiser. I am certainly more informed than I was in my post-college days. Forget about the sweet bliss of academe.

Anyway, the 2000 Presidential contest was terrible. I do not recall much about Dubbya and did not see Gore as his polar opposite at the time. But the way the election was decided really set the people off in opposite directions. Again, I am not taking sides here.

My thoughts about 43 were not favorable but he did rally the country post 9-11. It was when people's pocketbooks got shredded in 2008 that I think the backlash against anything related to elephants began. The tide sweeping 44 into office and flooding the congress with the donkeys was indeed a political tsunami.

The pendulum had swung to an extreme.

Then came 2010 and the Tea Party rode the pendulum to the other side. Or did it? It seems that those coming into power did not fulfill their promise and back went the pendulum. Occupy arose.

But thanks to the the economy, the pendulum started to move yet again. Enter SCOTUS on healthcare and the afterburners kicked in.

We've had back and forth in this country since it began. But over the past two presidents the magnitude of the swings seems to have grown exponentially. A Canadian colleague just asked in a Facebook thread, "Why is the US so divided and hateful? This has gone away past politics."

Indeed.

I have no solution although I would support term limits in congress. Can our leaders actually do the work we hired them to do instead of working from day one on their re-election? Donkeys and Elephants are both guilty.

Subscribe to:

Posts (Atom)