I've been watching stocks that break like Chipotle broke last week. You see stories right after the move saying they are a buy now. Why? Because the price is down and fundamentals have not really changed - yet. That kind of advice is certainly better than downgrading the stock to "market perform" after the break.

But when stocks break that kind of size, they are indeed broken, not on sale. Just look at Green Mountain Coffee (and its P/E was not in the 50s before the break).

or Best Buy in 2010-2011.

or Netflix

or Cisco

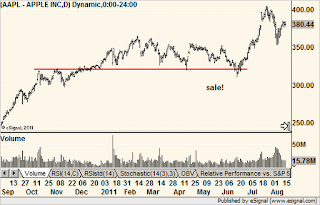

Take a look at a stock on sale. Apple sold off and broke support in 2011 only to recover instantly. Note the day of the low, in candlesticks, was a hammer, too.

A false breakdown is a sale price. A giant gap down is a mortal wound.

No comments:

Post a Comment